A benefit in kind is any non-cash benefit of monetary value that an employer provides to employees. Unlike statutory benefits, which are mandated by the government, benefits in kind are something that a company offers at its own will.

There are many reasons why a company may consider outsourcing payroll operations. Deciding whether it makes sense in the first place and what type of setup and partner are right for the situation requires the evaluation of a lot of pros and cons. Throughout my career, I have had to make these payroll outsourcing decisions and would like to take you through some of the logic I have applied, so that you can make a decision that you feel comfortable with.

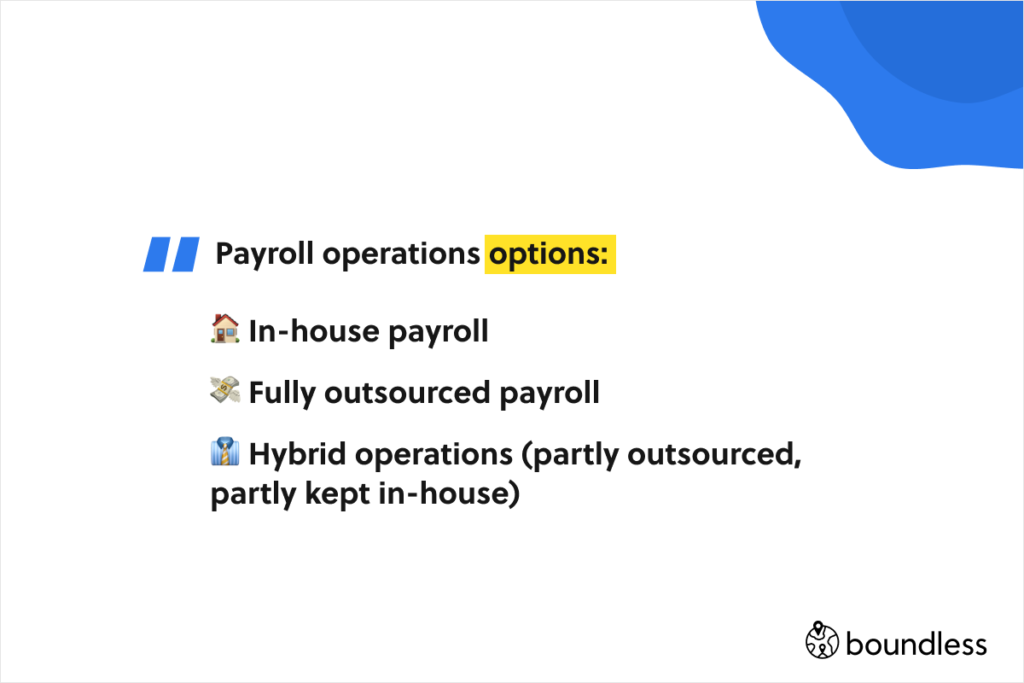

Before we get into how you will choose what the best payroll outsourcing option is for you, it's important to understand what your options are.

This is the option whereby everything related to the payroll is kept inside the company. This means that you handle all initial registrations and then beyond that, on a month-by-month basis, you follow a predefined procedure. We have written about this in detail in our piece about setting up international payroll operations, but loosely, these are the steps you can follow.

One-off tasks:

Each month

Before you decide to run payroll in-house, consider if you have the right payroll knowledge internally. Part of this is understanding rules, regulations, and deadlines, and another important piece is ensuring that your team is sufficiently tech savvy. In the last decade, payroll processing has become more and more an activity akin to data science. Information comes from multiple sources and varying platforms that need to somehow integrate with each other so the final paycheck has all necessary components: time-keeping system, benefit (e.g. pension/healthcare) provider database, government gateways, and others. Aside from managing these data sets, good payroll practices would also call for establishing various automations as many of the tasks are repeatable and the less manual they are, the higher the chance for 100% payroll accuracy.

You rely on payroll partners to handle most of the above, especially monthly recurring activities. Even if you outsource payroll operations, you will still need to ensure that all of the above tasks are done accurately and on time. Most importantly, you still need to be a registered employer in the country and do tax filings on behalf of your company and employees. If you are entering a new country, the process of registering as an employer can be very slow.

Relying on an external vendor does not mean that you forget about your payroll, as you should make sure that you agree on a strong process that allows you to exchange payroll-relevant data with the partner monthly. You will need a process that ensures all payroll changes, and information on joiners and leavers, are collated on your side, and communicated effectively and on time to your payroll partner. Your payroll partner does the rest, and will advise you on local regulations and deadlines, but you need to ensure building a strong relationship with them. As you will see below, this makes a lot of sense when you venture into new countries.

A third option is to have a hybrid solution, where some of the payroll operations still happen in-house (your home country payroll for example) but for others (new territories where you have a few remote employees for example), you partner up with payroll providers. This means that for some employees you will be doing all the work, while for others you will rely on partners who you will manage.

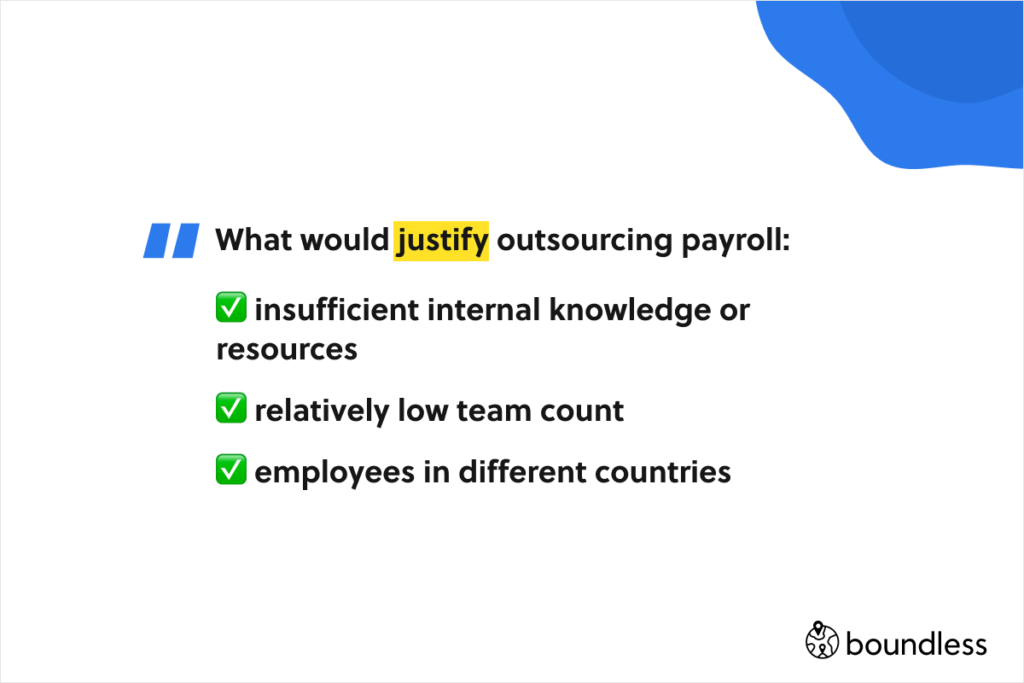

There are many reasons why you may be tempted to outsource payroll operations: insufficient internal knowledge or resources (especially the case in smaller companies), relatively low team count, employees in different countries, a desire to take the pressure off as employee count increases but before you have the time and resources to build a payroll department. While these are all legitimate reasons to outsource payroll, not all of them may justify the inevitable reality that the moment you outsource payroll you lose some of the control you have over payroll operations.

My rule of thumb is that when a company reaches a a sizeable number of employees locally that is relatively consistent (let’s say around 250), building an internal payroll team could be an option to consider, particularly if you already have a good finance and accounting operations team and want to incorporate the payroll function into this department and leverage their capabilities to manage payroll internally. For new countries, the effort to gain all the knowledge required to employ someone locally and run compliant payroll is quite high, so initially, outsourcing will be justified. However, once you reach a significant number of employees (80+), you may wish to to start considering the stage at which it may make sense to bring payroll in-house.

There are exceptions to the above rule in cases where the countries are similar enough that it may still make sense to keep payroll in-house, even though you are technically employing someone in a different country. An example of that would be Ireland and the UK where the regulations are very similar, without any language or other complication barriers. That said, you will still need to be registered as an employer in the country and have a locally compliant payroll solution. It’s also worth bearing in mind that your payroll team will need to keep up-to-date with all changes to the local tax system and payroll requirements. The training which this requires can be difficult to support for countries with smaller teams.

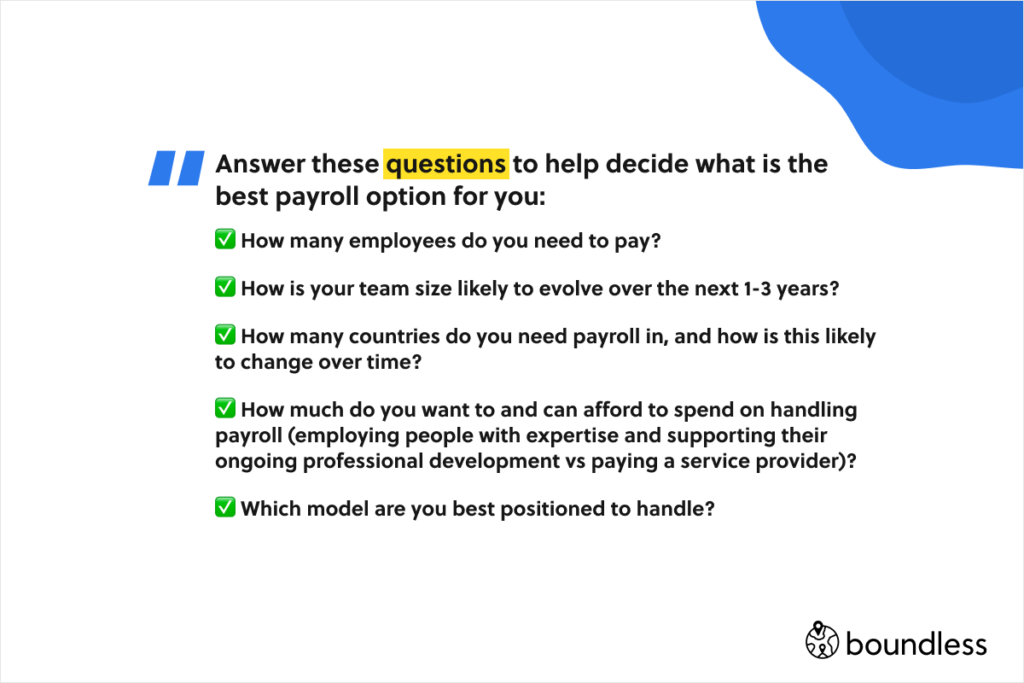

You can only make the best decision for you if you objectively assess your situation. Some questions that are helpful to answer:

These questions are important to answer because not only will they guide you to what the best option for you is, but also the specific type of payroll provider you should be looking for.

Local vs. multi-country payroll partner

If you have evaluated your options and decided that outsourcing payroll partners for the countries where you want to employ people makes sense, the next thing to do will be to figure if you want to go with a local or a multi-country one. There are, once again, pros and cons to each option, which will be important to understand.

A local partner will give you the confidence that you are working with a partner whose only job is to thoroughly understand that country and its payroll regulations inside out. However, they will also have their own way of working, which you will have to get used to. Once you have multiple countries to deal with, the overhead of managing each relationship will grow exponentially. Each service provider will want to collect data on a monthly (or weekly, where relevant) basis in a different format - some will want spreadsheets, some will want a form filled in, some will use email, some will want you to log in to their portal. It's not unheard of for finance and HR teams at large corporations to have to complete up to 30 different spreadsheets each month, to get information to each of their providers. On top of that every provider will have their own response times and communication styles. You will have to adapt to all that.

Choosing a single partner that manages multiple countries can solve that overhead. You will either have one point of contact or if you have a few, they will still have similar approaches and communication styles. You will also have to manage one service agreement. Since everything will be centralized, each country will feel very similar. However, because you will be relying on one partner for a lot of countries you will want to make sure they really are the right fit for you as having to change partners for all your countries can be very time consuming.

The biggest multi-country payroll providers on the market include ADP and NGA, used by many of the biggest multinationals in the world. Other companies that provide multi-country payroll services to medium and smaller entities include KPMG, EY, Deloitte and PwC. Each has a service that is standardised in many countries and will ask for similar data exchange.

So how do you decide? Here are a few principles I operate by:

If you have evaluated the above and have arrived at a clear understanding that working with a partner is the right choice for you, then it's time to find and select the best partner. Whether you are choosing to outsource payroll through a local or a multi-country partner, the following framework should help you make a confident decision:

As you can see, making a decision about how you run your payroll operations, especially in different countries, is not straightforward. If outsourcing payroll sounds like something that you might want to give a try, Boundless can help. Working with us will give you the comfort of having local payroll providers but spare you the overhead of communicating with different partners in different countries, as we bring all multi-country operations in one easy to use platform. You also will not need to register as an employer in the country since as an Employer of Record, we will act as the local employer and take care of all tax filings and payments, as well as all other compliance. Learn how Boundless can help you.

A benefit in kind is any non-cash benefit of monetary value that an employer provides to employees. Unlike statutory benefits, which are mandated by the government, benefits in kind are something that a company offers at its own will.

As an employer, what are you to do if an employee asks you to move back to their home country? Should you do the right thing and allow them to move back, and if you do, how do you deal with this from an operational perspective? Let's find out!

The most crucial aspect of international employment is understanding the law in the country where your employee is relocating. Every place has its own unique rules on your contractual obligations, statutory notice periods, taxation, and employee protections.

In this guide, we’ll cover the basics of setting up global payroll, the different ways of managing the process, how external payroll partners operate, and best practice tips to avoid common stumbling blocks when managing payroll on an ongoing basis.

An extensive guide on how benefits in kind tax works around the world, when employees are exempted from it, how companies can offset it, and how to file benefit in kind taxes accurately for your employees.

Payroll is the process and system by which a company pays its employees, and involves keeping employee financial records, calculating their paycheck taking wages, taxes, tax credits, allowances, and benefits-in-kind into consideration. Here is what you need to understand about international payroll.