An extensive guide on how benefits in kind tax works around the world, when employees are exempted from it, how companies can offset it, and how to file benefit in kind taxes accurately for your employees.

Marco Pasqualin leads Global Payroll at Boundless and has learned the ropes of payroll operations over the past 13 years working for the likes of Apple and Aldi. He has picked up unique insights on the complexity of global multi-country payroll, juggling dozens of inputs to produce correct payslips and compliance with local rules and laws. He shares some international payroll fundamentals in this post.

Irrespective of where in the world it's done, payroll is the process and system by which a company pays its employees, pay period in and pay period out. It involves keeping employee financial records, calculating their paycheck taking wages, taxes, tax credits, allowances, and benefits-in-kind into consideration, and issuing those paychecks. Regardless of where the company or its employees are based, every employee must receive the accurate pay (and payslip) with all withholdings and deductions submitted to the local tax authorities.

Before a company can run payroll in a new country, it needs to look into a host of country-specific items: from immigration and employment law compliant contracts, through to corporate presence and tax registrations, all the way to social security registrations and mandatory employer contributions. As you may have seen us mention before, as far as any of these are concerned, countries vary massively. I learned first hand how big the step was from "doing payroll in Italy" to "doing international payroll." In this article, I want to tell you about five elements of payroll you will encounter as you pay people compliantly beyond the borders of your HQ country.

This is the most fundamental thing to understand about international payroll. Due to all the varying taxes, tax bands, allowances, contributions and tax credits that both the employee and the employer are liable for, the same gross salary number for an individual will produce different net values depending on the country.

Calculating cross border salaries is no easy feat. Our CEO, Dee recently wrote about her struggles with that as a few employees decided to relocate from the HQ of the company she was working for. She had to figure out what the company's employees' current net salary based on the Irish tax system would translate into at their new location. That called for doing both a gross to net (looking at capping the company cost at its current level) and a net to gross (looking at keeping the employee at the same level of take-home pay) calculation for each employee.

Once she got to the numbers, she could have an informed discussion with the employees. I will give you an example to see how international payroll numbers could change between two jurisdictions.

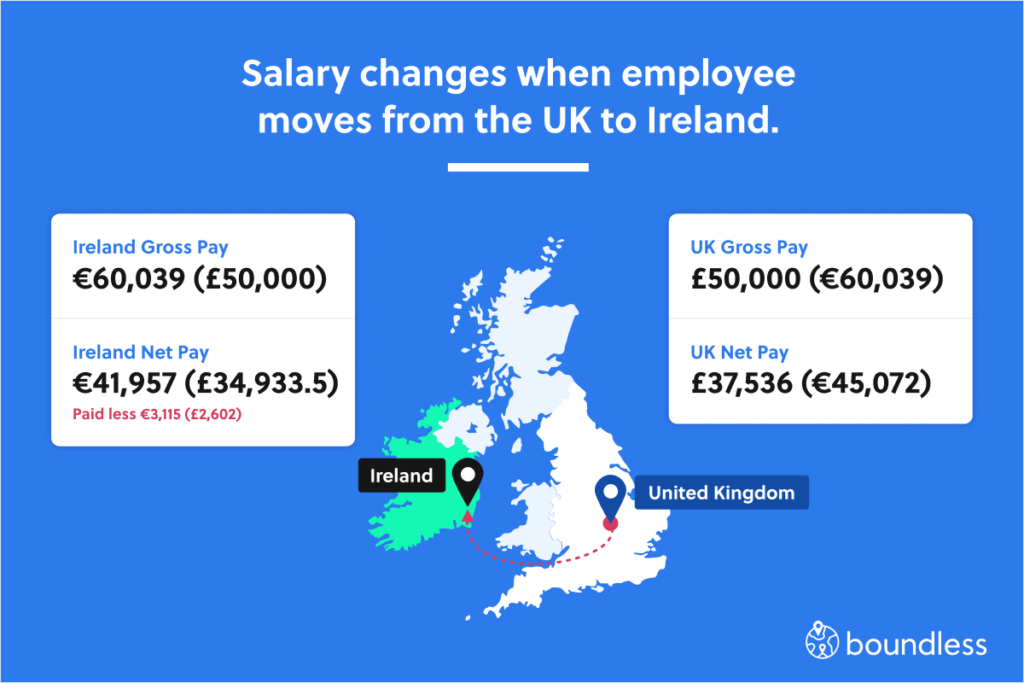

Mary works for a British startup, but with Brexit going ahead, she has expressed an interest to move to the Republic of Ireland as she wants to live in an EU country. Her annual gross salary in the UK is £50,000 (€60,039). After tax, Mary, who is single, doesn't have children or a mortgage, takes home £37,536 (€45,072). However, if she moved to Ireland on the same gross salary (equaling to €60,039), her net pay will be €41,957(£34,933.5) or €3,115 (£2,602) less. She knows that Ireland is as expensive as the UK and wouldn't like to receive less just because she has decided to move countries. For her to receive the same net pay, her employer would have to increase her gross salary to €66,087 (£55,024.50).

A lot of the information needed for this kind of calculation is particular and not readily available online. At Boundless, we have developed a calculator to help us make international payroll calculations easily. As we can already serve your Irish and UK-based remote workers, the calculations would look very similar to the one I showed you above. Below are five distinct aspects to payroll that go in the backend of this calculation.

Unless an employee is based in one of thirteen countries that do not withhold any personal income tax, a percentage of the income will have to be deducted. Some countries will not start taxing people until a specific salary is reached (e.g. £12,500 in the UK). Once the income is taxed, the percentages vary drastically between countries. Some countries such as Hungary have a flat income tax rate of 15%, while others increase progressively as the income increases.

There is no unified way of progression among countries. In Ireland, there is only one change, doubling the percentage from 20% to 40% when income passes €35,300. Chile's lowest band is at 4% and highest at 35.5% while Sweden's first is 32%, while the highest is 57%. In other countries such as Spain, there are four bands: 19% until €12,450, 24% until €20,200, 30% until €35,000, 37% until €60,000 and 45% for everything above.

The US adds a level of complexity to income tax because there are federal and state income taxes applied to personal income. Federal and state taxes vary significantly across the US. All federal income taxes are progressive, while only some state ones are progressive (Hawaii has 12 bands), while others are flat. Some states do not charge income tax at all, such as Florida.

Beyond income tax, many other taxes need to be taken into consideration as the payroll of an employee is calculated. Again they will vary significantly between countries and within regions, states and provinces, which impacts international payroll. While most jurisdictions have a version of healthcare, social welfare, and pension contributions and taxes, there are some very country-specific taxes. I will give you five examples below:

These are only some of the examples of taxes you would need to consider as part of the payroll for people residing in those countries.

Most countries will offer some tax credits, and deductions on the amount of tax that people need to pay based on family status, disabilities, or private pension contributions. However, many country-specific tax credits apply:

All these are part of the income tax calculations that you will have to make for someone residing there and add a layer of complexity to international payroll.

Benefits (typically monetary compensations such as 100% top-up of salary during sick leave, X number of weeks of additional paternity leave that is fully paid) and benefits in kind (non-monetary such as car, phone, health insurance coverage, gym membership, lunch vouchers, etc.) are certain perks that companies can decide to provide to their employees. While the benefits-in-kind are offered free of charge from the employer, the employee, in certain jurisdictions, may be liable to paying tax on them. Here are some more obscure examples:

Beyond all the taxes, tax credits and benefits, something that needs to be part of payroll are various allowances stipulated by employment law that need to be granted to employees. Here are three examples that may surprise you:

While these examples may feel a bit overwhelming already, we have only scratched the surface of complexity here. As you decide to expand payroll to other countries, the only way to stay on top is to make sure you find the best possible partners. Connecting with local accounting, tax and other fiduciary associations, such as the Global Payroll Association (Boundless is a member) can be of great help. Changes usually happen at the beginning of each year, so that's the best time to do your research.

Alternatively, you can look into working with an Employer of Record such as Boundless that takes care of payroll, tax filings, and all other legal obligations for your local employees. Learn more here.

An extensive guide on how benefits in kind tax works around the world, when employees are exempted from it, how companies can offset it, and how to file benefit in kind taxes accurately for your employees.

There are many reasons why a company may consider outsourcing payroll operations. Before we get into how you will choose what the best payroll outsourcing option is for you, it's important to understand what your options are.

As an employer, what are you to do if an employee asks you to move back to their home country? Should you do the right thing and allow them to move back, and if you do, how do you deal with this from an operational perspective? Let's find out!

Before you can pay a single person a single cent, you have to be set up as an employer in the country where the worker is tax resident. In this post, we offer an 8-step “Do-It-Yourself” guide to setting up international payroll operations for your company.

In this guide, we’ll cover the basics of setting up global payroll, the different ways of managing the process, how external payroll partners operate, and best practice tips to avoid common stumbling blocks when managing payroll on an ongoing basis.

Every company has their story of how they became remote and distributed. At my last company, we became a distributed organisation organically, rather than proactively and here's how it worked.