Running a global, remote-based organisation carries a raft of HR compliance challenges. But fear not! We’ve come up with a simple guide to help you meet these challenges head-on and establish yourself as a leading, people-first employer.

Considering employing someone in The Netherlands? To do that compliantly, an employer has a lot of obligations they have to fulfil. One comprehensive and important topic is the set of local employee rights a remote worker in The Netherlands is entitled to.

Below is a guide to employee rights in The Netherlands to help you understand what you need to comply with. (You can read about employee rights in Australia, Brazil, Canada, Croatia, Ireland, France, the UK, Portugal, Poland, Germany, Lithuania, and New Zealand).

To employ someone in The Netherlands, you need to be a registered employer. To get a full overview of what that would take and see all the obligations you will have as an employer, please read our Netherlands Country Guide. Alternatively, you can work with an Employer of Record, such as Boundless, which will employ the worker on your behalf locally. That would spare you any registrations and ensure compliance with employment law, all the while assuring harmonised experience for your employees there.

Regardless of the employment approach, all employees in The Netherlands are entitled to the following employee rights.

The employer must provide the employee with a written statement setting out specific terms of the employment along with an employment agreement, which can be verbal or written in any language as long as both parties fully understand the terms. The employee can request a Dutch translation of the employment agreement, which the employer must provide. The written statement must contain:

An employment agreement may be in the form of a contract signed by both parties, an exchange of letters, or a simple document. A non-competition clause can only be agreed upon in writing, or otherwise will be deemed null and void. References to a non-competition clause in a CLA or in an internal handbook is not binding to the employee. Employees on fix-term contracts cannot agree on a non-competition clause (unless the employer can prove that doing so is necessary). The employee can ask for the restrictive claim to be cancelled or mitigated.

Employees must receive their employment agreement within one month of starting, and should include the following terms and conditions:

The employer may only amend the employment conditions unilaterally if it has reserved the right to do so in the unilateral amendment clause (included in the employment contract or personnel handbook) and has a substantial reason that overrides the employees' interests. It is complicated to amend employment conditions unilaterally, and existing cases show that Dutch courts exercise great restraint in allowing a unilateral amendment of employment conditions, especially if the change is to employment conditions such as salary.

Under the Flexible Working Act, employers must allow employees to work part-time or to work flexible hours. The employer can only turn down such a request if there are strong and objective reasons not to permit it.

After six months of employment, employees can request an adjustment of their working hours and workplace (i.e., work from home). If the employer denies this request, the employee can file a new one after a year. Only employers with ten or more employees fall under the scope of the Flexible Working Act.

Employers must provide a payslip to their employees, which can be online.

The equal treatment legislation prohibits employers from discriminating employees based on gender during recruitment, vocational training or guidance given to employees. The aim is to eradicate any wage differences (including salary, allowances and reimbursement of expenses) between employees doing the same work purely based on their opposing genders. This applies to both individual employment contracts and CLAs. Any provisions that seek to depart from the principle of equal pay are void.

An employee's potential claim against the employer arises the moment their wages are due. The employee is entitled to the difference between the salaries for up to five years in arrears. On top of that, employers may also have to pay a penalty.

Separate from the non-competition restraint, an employee carries a post-contractual duty of care. This means they cannot systematically solicit the former employer's employees or customers by using business information they received during the former employment relationship. Furthermore, they may not violate their former employer's trust (i.e. keep trade secrets confidential), or make misleading or derogatory remarks about the former employer or its business. The employee's new employer may also be liable if they knowingly benefited from or encouraged the employee's breach of their duty.

Employees are entitled to a safe and healthy work environment under the Working Conditions Act (ARBO). In work environments with high potential for injury, the employer must provide protective wear free of charge. Employees can claim compensation from the employer for any damage they have experienced such as an injury or psychological stress. The exceptions are if the employer can prove that either they fulfilled their obligations under Dutch legislation or that the employee’s damage is their own doing.

The employer must keep an inventory in writing and evaluate the risks of the work involved for the employees. This risk-inventory and evaluation must contain a description of the dangers, the risk-restrictive measures and the threats for special category employees. Furthermore, the employer is obligated to take out employee accident insurance that insures employees against accidents on the work floor and during their commute to work (including those employees who use their car for business purposes)—view self-assessment risk tool.

Home Offices

Employers have less responsibility for the working conditions of employees who work from home or different locations (mitigated working conditions). However, employers are obliged to give information and support to location-independent employees.

Employers are required to provide an ergonomic workspace to employees working from home unless that places unreasonable demands on the employer. An example would be if the employee only works from home occasionally or for a brief period. The employer bears the cost of the equipment and setup required to create a decent workplace, including monitor, office chair and keyboard. There are tax benefits available, making it possible for employers to provide equipment tax-free.

The probation period can be a maximum of two months for open-ended or 2-year contracts and one month for less than 2-year fixed-term contracts.

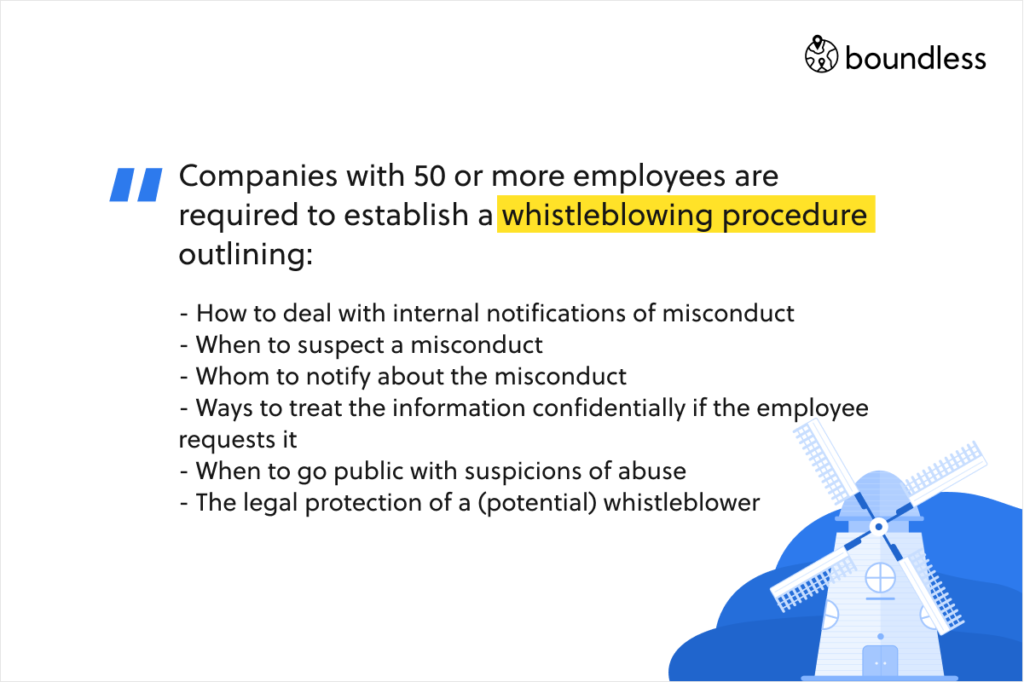

Whistleblower protections in companies with 50 or more employees are important employee rights in The Netherlands, employers should comply with. Smaller companies that do not have whistleblower procedure in place may notify a supervisor, inspectorate or the House for Whistleblowers.

According to the Whistleblowing Act, an employee can disclose any reasonable suspicion of abuse by their employer or at another company and impacts public interest. Whistleblowers, who did the right thing by reporting misconduct and acted in good faith, cannot be disadvantaged in their legal position.

Companies with 50 or more employees are required to establish a whistleblowing procedure which outlines the following aspects:

Employers must have a policy on sexual harassment at the workplace as part of their obligation to provide a safe work environment and prevent employees from suffering damage while performing their working activities.

The Dutch anti-discrimination law covers all aspects of the employment relationship including hiring, terms and conditions of employment, promotion, training and dismissal. Under the Dutch Constitution, all individuals within the Netherlands must be treated equally in comparable cases. Under the equal treatment legislation, discrimination on the grounds of religion, political view, life principles, race, gender, pregnancy, civil status, sexual orientation, disability, nationality, age, type of contract and working hours is prohibited. Employers must have in place a policy to prevent discrimination and any psycho-social burden.

Discrimination includes:

Employers who do not comply with the Working Conditions Act risk getting a compensation claim from the employee and may be fined. The employee can claim that the employer has violated their duty of due care, and they have incurred damage as a result. Furthermore, the employee who feels discriminated against may address the Netherlands Institute for Human Rights and/or initiate court proceedings to claim damages.

Protection from dismissals following a business transfer, pregnancy, illness, maternity and parental leave, marriage, membership in a trade union or works council, and others are all seen as employee rights in The Netherlands.

Furthermore, a dismissal following an organisational change such as discontinuation of business activities requires the employer to observe genuine objectivity in selecting employees for redundancy. It is not possible to choose employees for subjective reasons.

Under the GDPR rules, employers are subject to restrictions when retrieving and disclosing employee data.

If an employer with 50 or more employees considers transferring all or part of the business, they must first seek advice from the works council.

Employees are automatically transferred and protected from dismissal under a business undertaking. For the Transfer of Undertaking Law to apply, the transferred business must retain its identity. In order for a business transfer to qualify as such, the main activity of the company must remain the same and a transfer of stock alone does not qualify. Employees can only be dismissed for financial, technical or organisational reasons during a business transfer. However, the dismissal procedure will require the employer to observe genuine objectivity in selecting employees for redundancy.

Transferred employees retain their continuous employment period, their existing employment terms and conditions (except old age, disability and survivors' benefits under occupational pension schemes), their employee rights to parental leave, extended notice periods, and severance pay. Separate arrangements apply to pensions.

An employee who agrees to other terms and conditions of employment (even if comparable to the current ones) before or during the transfer can successfully claim that the amendment is invalid. They can claim their former terms and conditions as of the transfer date, or a one-off payment for the differences between the packages. Furthermore, the employee can request a court to terminate the employment contract. In case the new terms and conditions are substantially detrimental to the employee, the court will hold the employer liable and will order them to grant a severance payment.

Employees who are being transferred can refuse it and will be treated as having resigned. If they exercise this right, they will not be entitled to severance compensation. Consequently, they will have no remedy against either employer, except under two circumstances:

In these circumstances, employees will be regarded as dismissed and may be entitled to severance payment(s).

As an employee right in The Netherlands, employees are commonly entitled to unpaid time off when moving house, or for weddings, funerals and GP visits, which however is not mandatory.

Employers must compensate employees when terminating their permanent employment contracts or any temporary contract that has lasted for 24 months or more. The compensation is:

The compensation is capped at either €75,000 or a full year's salary if the employee earns more than this amount. If the employer and the employee decide to terminate the contract by mutual consent, the employee can negotiate a severance payment with the employer.

Employees who lose their jobs for any reason other than their own doing are eligible for unemployment benefits (WW). The amount is roughly 70% of the employee's previous salary.

To receive the basic unemployment benefits that last three months, the employee must have worked in 26 of the 36 preceding weeks before becoming unemployed. Depending on how many years the employee has worked, they may receive benefits beyond the three months.

As an employee right in The Netherlands, employees who are ill are entitled to at least 70% of their most recent gross base salary, for up to 104 weeks covered by the employer.

If an employee gets injured on the job, the employer must report the accident immediately to an SZW inspector. Employers pay into the workers' compensation system, which is governed by the Work and Income According to Labour Capacity Act.

Employers must record all reported accidents as well as those that resulted in three sick leave days or more. They have to include information on the nature of the accident and its date and make all this information available to employees.

To find out about all statutory benefits in The Netherlands as well as how leading employers enhance them, download our benefits benchmark infographic.

The employer must set up a works council if employing 50 or more people within the Netherlands. They must then seek the advice of the works council in cases of transfer of the company control, termination of or significant change of company activities, major investments, merger or takeover.

If the employer disregards the advice the works council gives them, they can file a complaint against the employer's decision. Furthermore, the works council can contribute to establishing, amending or cancelling various company arrangements about work hours, vacation, job evaluation, remuneration systems, working conditions, privacy, sick leave. The works council is entitled to regular information from the employer and can make proposals to them.

Employment agreements lasting more than six months must state whether they will be terminated or extended upon the end date, and if so, on what conditions. The employer must notify the employee at least a month before the end date of the agreement. If the employer fails to do so, they have to compensate the employee for each working day delay. The maximum compensation is a month's gross salary.

Regardless of whether the employee has been notified or not, the employment agreement will end by operation of law. The duty of notification does not apply if:

Adhering to employment law and employee rights in The Netherlands will require a commitment to learning and working with a lot of local regulations. We are here to help you on that journey and take the time to make sense of complex legislative information, which we turn into easy to understand resources and comprehensive country guides (check our guide to The Netherlands).

However, staying on top of Dutch employment law may not be a top priority for you right now. That doesn’t mean you should give up on employing your next remote worker out of The Netherlands or opt for hiring them as an independent contractor instead (which is a bad idea).

Boundless can help you employ anyone in The Netherlands legally and hassle-free. We own and operate a Dutch Professional Employer Organisation as part of our multi-country offering. Through the Employer of Record model, we act as the legal employer to your remote workers and take care of the many obligations that come with adhering to these employee rights in The Netherlands. Learn more.

Running a global, remote-based organisation carries a raft of HR compliance challenges. But fear not! We’ve come up with a simple guide to help you meet these challenges head-on and establish yourself as a leading, people-first employer.

For years employees have been clamouring for more opportunities to work from home; to work overseas; to live a more flexible and balanced life. However, when it comes to being legally employed to do so, things become a lot trickier.

There is no easy answer to figuring out what benefits UK employers should be offering. It will depend on what is important to you, what your budget is, and what matters to your people. Having the answers to all of these questions, you will be in a better position to find the right solution for you.

Hello! We’re Boundless, and we make it easy to employ anyone, anywhere! Boundless makes it possible to get up and running quickly, with less effort, for less cost.

Considering employing someone in Canada? To do that compliantly, an employer has a lot of obligations they have to fulfil. Here is a guide to employee rights in Canada to help you understand what you need to comply with.

The Right to Disconnect in France was introduced in 2016 as part of a much bigger update on French employment law that aimed to bring much more flexibility, and make it more fit for purpose in an increasingly digital world.