Considering employing someone in France? To employ someone there, you need to be a registered employer. Get a full overview of what employing someone in France would take and see all the obligations you will have as an employer.

When an employer decides to legally and compliantly employ an internationally remote employee, one of the first things they need to come to terms with are the employee rights of their country.

Below is a guide to employee rights in Ireland. (We have developed similar guides for Australia, Brazil, Canada, Croatia, France, the UK, Portugal, Poland, Germany, The Netherlands, Lithuania, and New Zealand). If you employ remote workers based in Ireland, you will need to comply with those rules, regardless of where in the world you are based. You will need to set up as an employer in the country. To get a full overview of what that would take and see all the obligations you will have as an employer, please read our Ireland Country Guide.

Alternatively work with an Employer of Record, such as Boundless, which will act as the legal employer of your employee.

Every employee in Ireland has the right to a comprehensive written employment contract, which covers a lot of the subjects that are included in Irish employment law.

While many employers give their employees a contract before employment commences, there are two deadlines that employers need to adhere to.

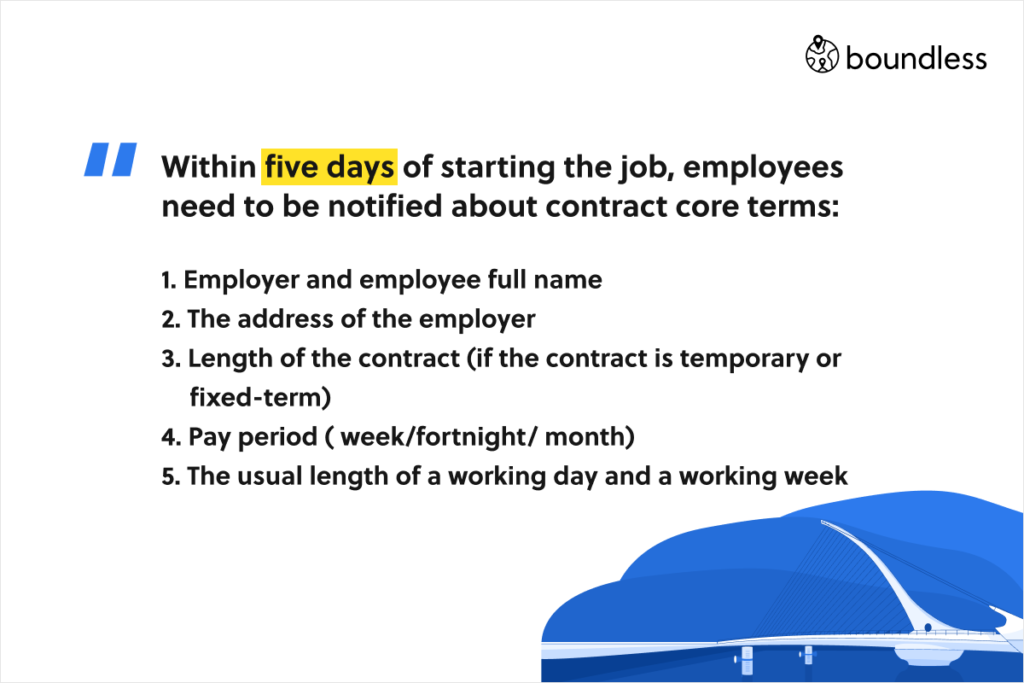

Within five days of starting the job, employees need to be notified about what is known as core terms of the contract, which cover:

Then within two months of the start date, the employer has to put in writing the following:

The employer must sign and date the contract, which should be in English.

Employees must be given a written statement of pay or a pay slip with every salary payment. A payslip will show the gross salary and detail all deductions. The employer must have the employee's permission to make deductions from their salary unless these deductions are authorised by law (Income tax, PRSI and USC). Remote employers can send electronic copies of the payslip. (You can read more about the steps it takes to set up international payroll here).

The employer is responsible for ensuring that employees have a safe workplace. This includes protection from violence at work, harassment and bullying, alongside any environmental dangers. Employers are expected to work to prevent any workplace injuries and ill health.

Every employer has to carry out a risk assessment for the workplace and identify any hazards present in the workplace - including psychological stress. Employers should assess the risks arising from such dangers and identify the steps to be taken to deal with any threats.

One important point to remote employers is that the same level of responsibility for the safety and health of employees applies when employees work from home. This means, employers should offer similar supervision, education and training, and implement sufficient control measures to protect homeworkers. (An example is Shopify Ireland, which asks new employees to send a video of their office). The employer should accept liability for any accidents or injuries of a homeworker as for any other employee. They should also do so if the employee is a remote worker for them and the employer is based in another country.

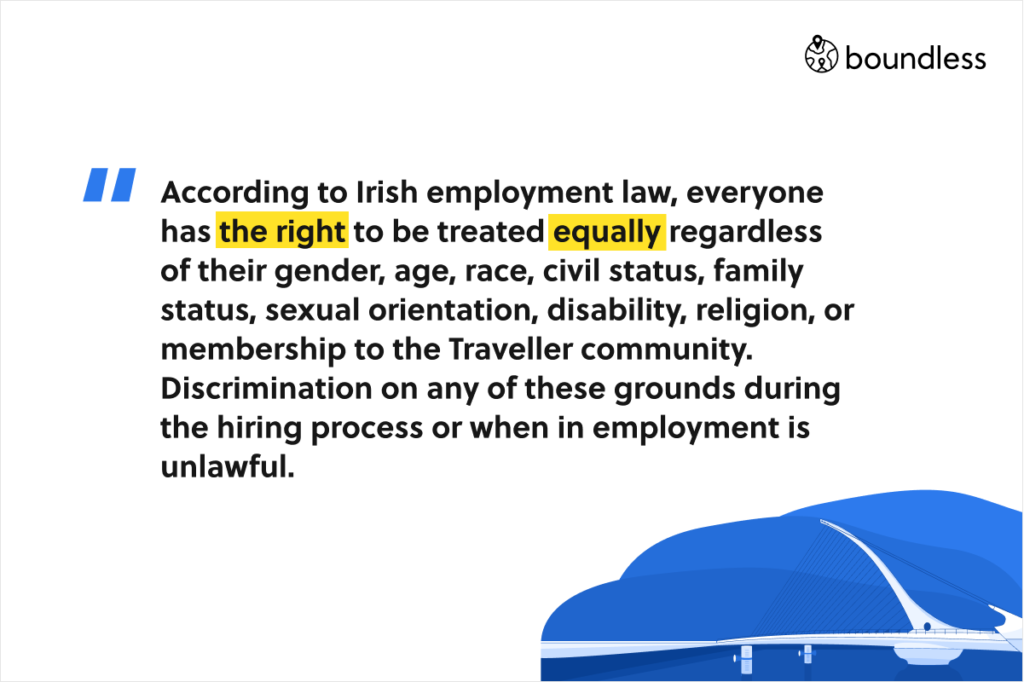

Employee rights in Ireland stipulate that every employee should be treated equally regardless of their gender, age, race, civil status, family status, sexual orientation, disability, or religion. One specific for Ireland ethnic origin anti-discrimination ground is Traveller community membership. Discrimination on any of the above grounds during the hiring process or when in employment is unlawful.

Discrimination may be direct or indirect. Treating one individual less favourably over another is seen as direct discrimination. Indirect discrimination, in contrast, occurs when an employer applies a particular condition to all employees that puts certain groups of employees at a disadvantage.

For employers outside of the EU, this is a particularly important point. Personal data of employees in Ireland (as well as anywhere in the EU) is protected by the General Data Protection Regulation (GDPR). Under GDPR, employers, remote or not, must comply with the following principles when handling the personal data of employees:

Organisations should have a Privacy Statement, which employees can easily access explaining what data is held and what it is used for. If you are working with an Employer of Record to employ your remote workers in Ireland, this is one of many things they will handle for you, ensuring all employee rights in Ireland are adhered to. Since employees are allowed to access their personal data, employers need to have in place a procedure for how these requests are handled within one month.

Under GDPR legislation, employees have the right to:

The Protection of Employees Act 2003 grants part-time and fixed-term employees in Ireland the following rights:

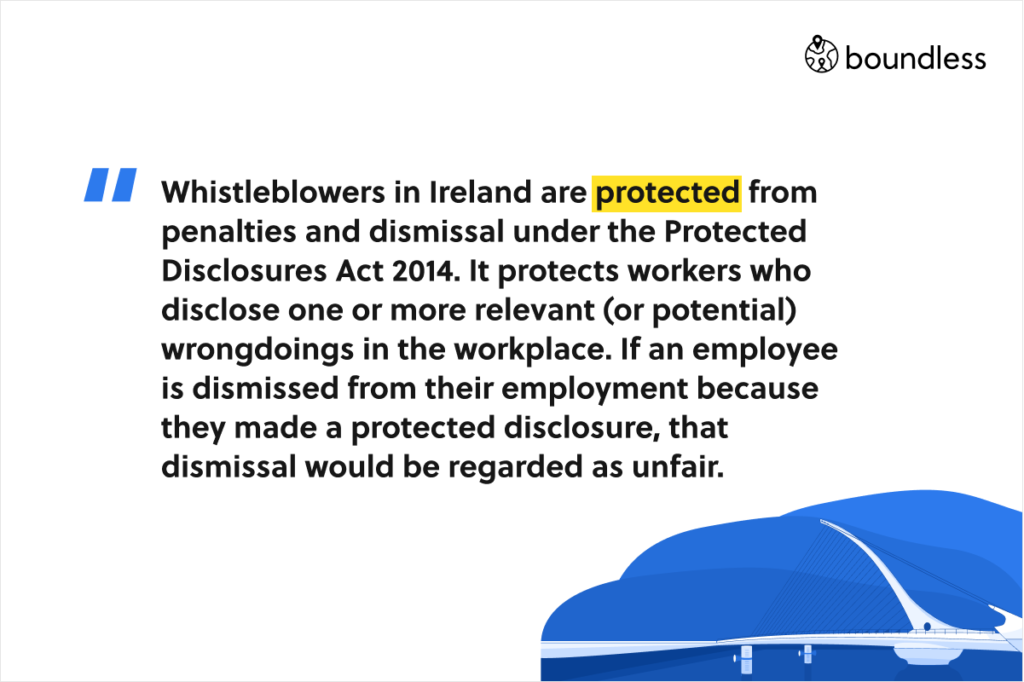

Whistleblowers in Ireland are protected from penalties and dismissal under the Protected Disclosures Act 2014. It protects workers who disclose one or more relevant (or potential) wrongdoings in the workplace. They must be revealing proper information and not a mere allegation or expression of concern which shows one or more relevant wrongdoings. Whistleblowers can be both current and former employees, as well as trainees, independent contractors, agency workers and people on work experience.

Wrongdoing is widely defined as:

Even if the disclosed information is proved to be incorrect, the person is still protected if they had a reasonable belief in the information. If an employee is dismissed from their employment because they made a protected disclosure, that dismissal would be regarded as unfair. In those cases employees have the right to appeal the dismissal as unfair. If their claim succeeds, the employee could be granted up to five years' gross salary compensation.

The European Union is currently working on legislation which, if enacted, will broaden the scope of the Protection Disclosures Act 2014.

Irish residents receive State Pension payments once they reach the age of 66, provided they contributed sufficiently to social insurance. According to Irish employment law, the employer isn't required to set up or contribute to a pension scheme as a benefit to the employee. However, if there is no pension scheme in place or the employee hasn't joined one, the employer has to provide access to a personal pension plan through a Personal Retirement Savings Account (PRSA) provider within the first six months of employment. (See here the full list of statutory benefits in Ireland and a benchmark on what are typical benefits in kind offered by Irish employers).

An important employee rights in Ireland comes into play when a worker has been made redundant. The employer has to compensate them. For every year of service, they have to compensate the employee with a two weeks' pay, which is capped at €600 per week, plus one additional week's wage.

Irish employment law guarantees a certain amount of paid leave that employees get (see our Irish benefits benchmark). However, employers are allowed to alter that amount (add, but not subtract) and have to agree with employees first. The annual leave pay is at the standard weekly rate.

For all grievance and disciplinary procedures, employers must have a written document following the Code of Practice: Grievance and Disciplinary Procedures. This sets out the stages and process followed when dealing with the alleged shortcomings or complaints of an employee. Employees have to receive a copy of these procedures within 28 days of the start of their employment. Generally, the procedures allow for an informal process/warnings, which escalate to a formal proceeding with written warnings and ultimately to dismissal. Employees have the right to ask for a written statement about the reasons behind dismissal, which the employer has to provide within 14 days of the request.

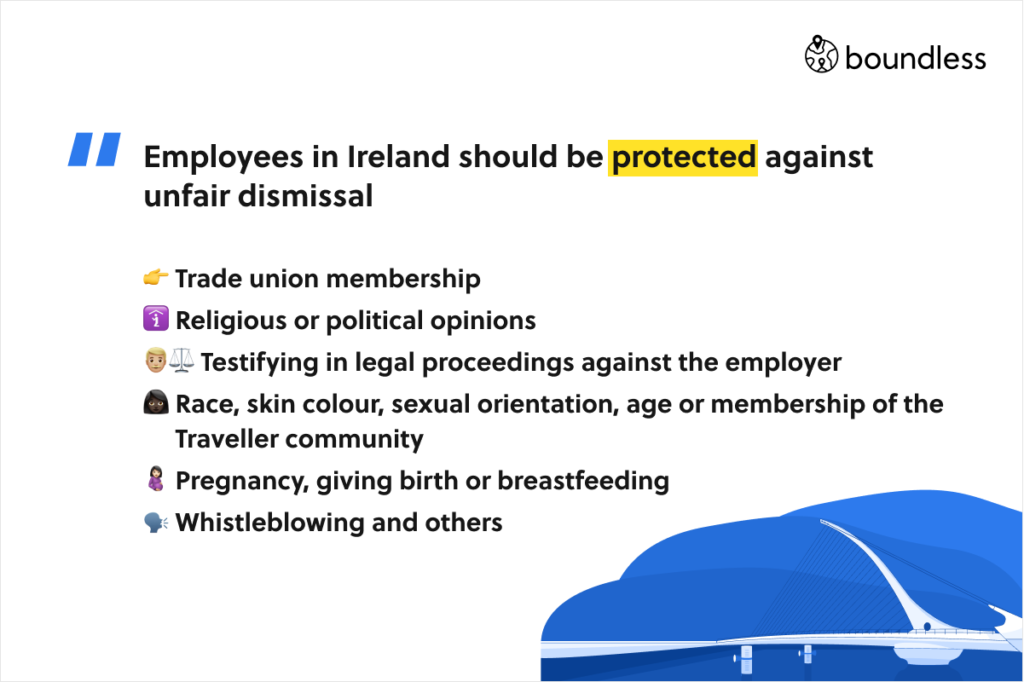

Every employee in Ireland has protection against unfair dismissal. Dismissals can be justified on the employee's competence, capability, or conduct. The following dismissals are automatically deemed to be unfair:

There are instances when an employer can dismiss an employee without notice. That is usually for committing gross misconduct such as assault, theft, or severe breach of employment policies.

All employees in Ireland have a constitutional right to join or leave a union; however, employers have a legal right to accept or not the union as representing the workforce. If employers choose to recognise one union, they must then recognise other unions organised by employees. Employees cannot be dismissed from their job for being a member of a union.

Adhering to employment law and employee rights in Ireland will require a commitment to learning a lot of local regulations. We are here to help you on that journey and take the time to make sense of complex legislative information, which we turn into easy to understand resources and comprehensive country guides (check our guide to Ireland).

If it all sounds a little too much for you, don't give up on employing your next remote worker out of the Emerald isle. Boundless can help. We own and operate an Irish Professional Employer Organisation as part of our offering, and through the Employer of Record model can act as the legal employer to your remote workers and take care of the duties expressed in this article. Learn more.

Considering employing someone in France? To employ someone there, you need to be a registered employer. Get a full overview of what employing someone in France would take and see all the obligations you will have as an employer.

Running a global organisation carries a raft of HR compliance responsibilities, which derive from local employment and labour laws. To make matters even more complicated, many regulations are amended every year and companies are expected to stay on top of new rulings.

In some countries, the Employer of Record model is not aligned with local employment legislation, which may restrict outsourcing of employment. To understand why Spain is a country we cannot currently support, it’s worth understanding how we operate in other countries.

The Right to Disconnect in France was introduced in 2016 as part of a much bigger update on French employment law that aimed to bring much more flexibility, and make it more fit for purpose in an increasingly digital world.

Considering employing someone in Poland? To do that compliantly, an employer has a lot of obligations they have to fulfil. Continue reading for a full overview of what employing someone in Poland takes and see all the obligations you will have as an employer.

Considering employing someone in Canada? To do that compliantly, an employer has a lot of obligations they have to fulfil. Here is a guide to employee rights in Canada to help you understand what you need to comply with.