A benefit in kind is any non-cash benefit of monetary value that an employer provides to employees. Unlike statutory benefits, which are mandated by the government, benefits in kind are something that a company offers at its own will.

A constant question on every employer’s mind is “What benefits should I be offering to attract and retain employees?”. This is no less a relevant question right now, with all the uncertainty in the world. With the advice in the UK continuing to be for everyone who can to work from home, professional and personal lives are blurred, causing increased fears of burnout. To manage employee anxiety, employers search for the right mix of benefits that may help employees cope and be motivated.

There is no easy answer to figuring out what benefits UK employers should be offering. It will depend on what is important to you, what your budget is, what matters to your people and what is proven to help right now. If you have the answers to all of these questions, you will be in a better position to find the right solution for you.

Boundless and Ben, a UK-based Benefits provider, are teaming up to give you everything that we collectively know about UK benefits and to create a comprehensive guide for you.

The guide is split into three parts. The first one, which you will read in this post, will go in-depth about the statutory benefits which UK employees get by default, explain how some employers augment those, and bring fresh data on the most common benefits-in-kind that employers are extending due to the pandemic. (Read the second and third parts).

Let's get straight into it.

There are a variety of mandatory benefits that UK employees are granted as an employee right. Many of them have to do with various forms of time off: from holiday and parenting to sickness and bereavement. There are two parts to any leave benefit - the entitlement in terms of time itself and the pay (or lack thereof) during this period. Beyond time off, two other notable statutory benefits are pension contributions and the ability to request flexible working. Below is a quick overview of each.

Employees in the UK are legally entitled to 5.6 weeks' paid holiday per year (28 days for an employee working 5 or 6 days a week). The employer can include bank holidays as part of statutory annual leave. The employer must pay for holidays that are not taken. Workers have the right to accrue leave during maternity, paternity, adoption leave or while sick. Pay in lieu of holiday can only be paid when an employment contract is terminated.

The holiday entitlement is comprised of two elements:

1. 4 weeks as defined by European legislation (and known as Euro leave), which even though the UK is leaving the EU has become part of the legislation and cannot be changed

2. 1.6 weeks as defined by domestic UK legislation

One thing, which is important to understand is that public holidays (varying from 8 and 10 in the UK) are not necessarily paid and falls within the employer to decide whether to do it or not.

How do great employers enhance this?

At a minimum, great employers throw in a few extra paid days off and also offer pay for bank holidays. They also provide the option to buy and sell additional days off. Many would also offer unlimited time off.

Statutory sick pay is available from the 4th day of sickness up to 28 weeks. Most employees are entitled to £95.85 a week from the government, paid at a daily rate. Employees have to provide a doctor's note after seven days.

Any statutory holiday entitlement that is not used because of illness can be carried over into the next leave year. If the employee is ill just before or during their holiday, they can take it as sick leave instead.

How do great employers enhance this?

Most companies provide a wider coverage of sickness payment through sickness & disability (directly or through the income protection insurance) both in terms of pay as well as time off allowed.

Employees are entitled to 52 week's statutory maternity leave regardless of their length of service. Those are split into three distinct periods:

1. Compulsory maternity leave - the two weeks following the baby's birth

2. Ordinary maternity leave - the first 26 weeks

3. Additional maternity leave - the last 26 weeks

Women do not have to take the whole 52 weeks but can choose to "share" this with their partner. But they must take the compulsory maternity leave.

Employees are entitled to take the leave regardless of the length of service. However, to be allowed maternity pay, an employee must reach 26 weeks of employment by 15 weeks before the expected week of childbirth. Statutory maternity leave is paid up to 39 weeks. Employees get 90% of their average weekly earnings before tax for the first six weeks and then either £148.68 or 90% of their average weekly earnings (whichever is lower) for the next 33 weeks.

How do great employers enhance this?

As maternity is such a big part of an employee's life, many companies put together Maternity policies that may include up to 35 fully paid weeks, including time for IVF treatments, breastfeeding support by covering devices, flexible (reduced hours) reintegration, and others.

All employees are entitled to 52 week's Statutory Adoption Leave regardless of their length of service. This is split into two types:

1. Ordinary Adoption Leave - the first 26 weeks

2. Additional Adoption Leave - the last 26 weeks

The primary adopter does not have to take the whole 52 weeks but can choose to "share" this with their partner.

The qualifying conditions for adoption pay mirror those for Maternity pay. Employees are entitled to take the leave regardless of the length of service. Statutory adoption leave is paid up to 39 weeks. Employees get 90% of their average weekly earnings before tax for the first six weeks and then either £148.68 or 90% of their average weekly earnings (whichever is lower) for the next 33 weeks.

How do great employers enhance this?

Adoption, similarly to maternity, is such a big part of an employee's life, that many companies top up the statutory benefit by offering up to 35 fully paid weeks, flexible (reduced hours) reintegration, and others.

Employees are entitled to 1 or 2 consecutive weeks' paid paternity leave. This applies when the qualifying partner in maternity and adoption cases may be able to take leave and pay. Paternity leave cannot start before a child's birth or placement for adoption and must finish within 56 days of delivery or adoption. The partner must satisfy three qualifying conditions:

1. 26 week's continuous service

2. Provide the correct notice to the employer

3. Remain an employee until the start of paternity leave

Employees get the same amount of time off regardless of the number of children being born or adopted at that time.

Statutory paternity leave is £148.68 or 90% of average weekly wage (whichever is lower). Tax and National Insurance will be deducted.

How do great employers enhance this?

Competitive employers in the knowledge work space offer up to 3 months of fully paid leave with the most typical being 2-4 weeks.

Employees are entitled to 18 weeks' unpaid leave for each child, up to their 18th birthday. A parent can take up to 4 weeks of parental leave for each child.

Employees must take the leave as a whole week. Parental leave applies to each child, not to an individual's job. To be eligible for parental leave, employees need to have been in the company for more than a year. Employees must give 21 days' notice before starting the leave.

Employment rights are protected during parental leave when employees need to spend more time with their kids, look at new schools, visit grandparents and settle children into new childcare arrangements.

How do great employers enhance this?

Great employers either pay for the statutory leave of 18 weeks or offer unlimited paid parental leave.

A pension is designed to fund an employee's retirement. Most annuities are 'defined contribution' pensions, which means that an employee and their employer each regularly put a set amount of money into the pension account. The value of the retirement when the employee retires depends on how much they've put into it and how the funds perform.

Employers are required to establish a "qualifying" pension scheme and enrol employees automatically. There is a total minimum contribution rate, often split between the employer and the worker. The employer has to contribute a minimum of 3%, and the employee has to contribute a minimum of 5%. There is tax relief for both employer and employee on the amounts they give. The current lifetime allowance stands at £1,073,100, while the annual one is £40,000.

How do great employers enhance this?

The way great employers help their employees is by adding more than the statutory minimum of 3%. A good practice is to have an employer contribution that is double of what the employee contributes. On average great employers contribute around 10% of the employee's salary, which brings the total contribution at about 15%.

A fundamental employee right and a statutory benefit to all is the ability to request flexible working. An employee can request after they have been with the same employer for 26 weeks. Flexible working includes job sharing, working from home, part-time, flex time and compressed hours, staggered hours, and annualised hours.

After the request has been made, employers have three months to review it and give their decision. In that time, they can assess the advantages and disadvantages of the employee working flexibly, have ongoing discussions, and offer an appeal process. An employer can refuse the request only if they have a good business reason to do so.

How do great employers enhance this?

Some great employers would allow for part-time or full-time work from home and also operate flexible work hours with only a few core hours when employees are expected to be online.

Beyond the statutory benefits, there are many non-mandatory benefits, also known as benefits in kind or fringe benefits, that employers extend to employees. Even before the onset of the pandemic, companies offered them in order to attract and retain talent.

However, businesses are now repurposing benefit budgets to accommodate for the radical new way of working and inevitably for employees’ changing priorities.

The focus now is on remote-friendly options so that all employees can enjoy their benefits from home, just as much as at the office. Some companies have reallocated office supplies and furniture budgets towards work from home allowances, gym subsidies have been put towards online fitness classes, and special moments are celebrated with e-gift cards and virtual socials. Even the much loved catered lunches can reach remote workers through services like Deliveroo for Business.

Friday drinks on Zoom, remote offsites, and wellbeing allowances are just some of the innovative ways that companies have been helping their teams through the pandemic. At this point, it’s become clear that employers need to be thinking of implementing solutions that will fit the new world of work and the needs of their people for the long term.

Through their unique Benefits Outlook survey, Ben has been collating data on the evolving employee benefits space, and hundreds of companies have responded so far. The results are really insightful and give a clear indication of what benefits are taking centre stage.

As part of the analysis, company benefit strategies were assessed against other businesses (of a similar size) and categorised as follows:

Results show that overall, 55% of workplace benefit solutions are lagging behind the industry average and 20% offer a competitive package compared to other businesses. Very few offered a great or leading solution. Statistics like this might seem discouraging but for those engaging in a benchmarking report like this one, it’s a step in the right direction, showing that building a successful employee benefits strategy is definitely high on the agenda.

Upon assessing benefit budgets, whilst 37% of respondents said they will likely decrease their budget, a whopping 29% are going to increase spend, despite the current uncertainty.

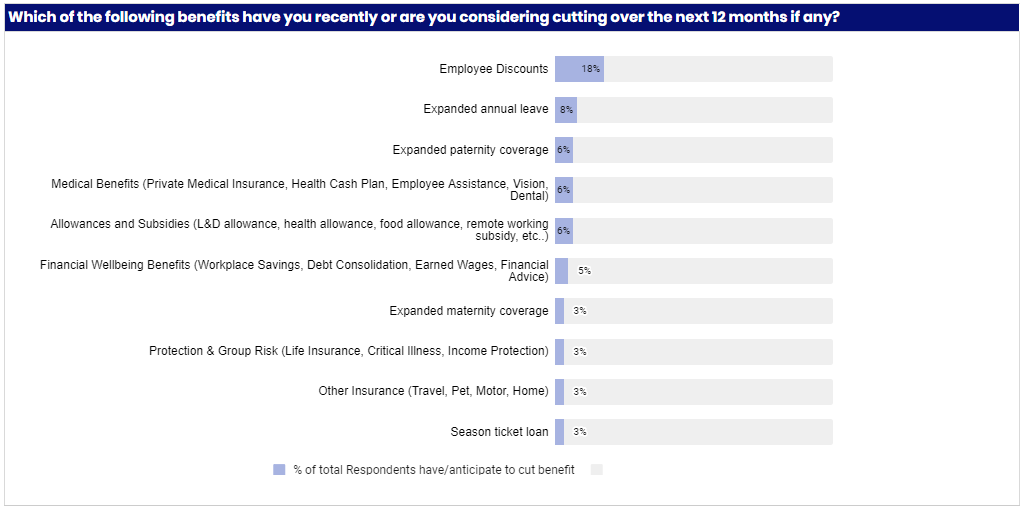

Of those scaling back on employee benefits, 18% are getting rid of employee discounts - a natural choice considering that the recession has hit the retail sector hard and people are becoming more cautious about their spending. Following that, expanded annual leave and paternity cover are both being reconsidered with albeit a small proportion - 8% and 6% respectively - reconsidering their offerings in these areas.

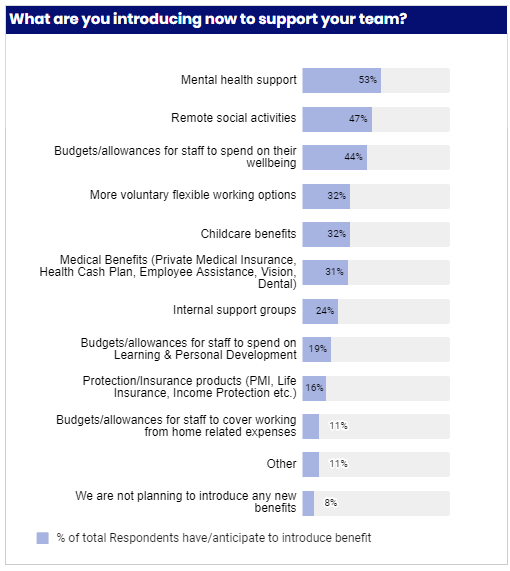

However, the inevitable cuts to employee benefits should not overshadow the positive progress that companies are making. There are seven key areas that businesses are investing resources into, including:

Topping the list is mental health support. With cases of mental health on the increase and being one of the most significant indirect health impacts due to the pandemic, it's important for employers to take mental wellbeing seriously. Over half of the companies Ben surveyed are adding mental health support to the employee benefits agenda and there are now a host of different ways to offer support. From online counselling, time out for mental health, workshops and apps, there’s plenty that can be done to create a safe space to open the conversation and reduce stress, burnout and anxiety in the workplace.

Fostering great company culture and keeping the community going also goes a long way to supporting mental health. Running online team events and socials that get everyone together are proving to be popular amongst employers. Arranging company activities doesn’t have to be costly either but can add so much value to employee happiness and wellbeing.

On average 32% of companies are adding personalised budgets for health and wellbeing and learning and development to the stack of benefits available. Since everybody is different, having a designated budget that allows people to spend on areas that matter most to them will undoubtedly have the most impact on the employee experience. Whether that be a yoga subscription, health supplements or upskilling in a specific software - by allocating budgets to include different products and services, businesses are likely to reap the benefits of considerable personal and professional growth.

One thing that has become apparent during the pandemic , is that giving people the option to work how, where and when they do best makes a lot of sense, that’s why 32% of companies are embracing flexible working. As you already learned earlier, flexible working is a statutory right in the UK, however employees have to formally request it. What we are seeing is that now a huge amount of companies are implementing it proactively. Similarly, around a third of companies are offering support for extra childcare to give parents the time to rest and recharge in order to give their best to both their children and the business.

The pandemic has certainly brought a new perspective on life, specifically, on one’s health. A third of businesses have taken this on as a priority, helping their teams get better access to necessary healthcare. We’ve come a long way from private medical cover alone ticking this box - employers are stepping up and covering costs of flu jabs, online GP consultations and at home blood tests.

To get a full overview of statutory benefits, as well as the benefits in kind that leading employers are offering in the UK, you can download this infographic by Boundless.

We hope this first instalment of the Boundless and Ben guide to UK benefits has already helped you in figuring out how to start creating or rethinking the package you offer to employees. In the second part of the guide, we will get into detail how all these wonderful benefits are taxed, what are some pre-existing allowances and tax breaks, and what are some newly introduced ones due to Covid-19. In the third and final instalment, we will provide you with the tools to build your bespoke benefits package with confidence.

If you need to understand more of the UK's employment legislation, have a look at our comprehensive UK Country Guide. If you need help with employing UK-based workers legally and compliantly Boundless can help. If you want to create a personalised employee experience through benefits, Ben can help.

A benefit in kind is any non-cash benefit of monetary value that an employer provides to employees. Unlike statutory benefits, which are mandated by the government, benefits in kind are something that a company offers at its own will.

When an employer decides to legally and compliantly employ an internationally remote employee, one of the first things they need to come to terms with are the employee rights of their country. Here is a guide to employee rights in Ireland.

Considering employing someone in Brazil? One area you need to master is the local employee rights a worker residing there is entitled to. Here is a guide to employee rights in Brazil to help you understand what you need to comply with.

Your employee benefits tell a story about what kind of business you are and how you value your people. If you get your benefits package wrong, you could miss out on the best hires or lose existing team members to the competition.

Considering employing someone in the Philippines? To do that compliantly, an employer has a lot of obligations they have to fulfil. One comprehensive and important topic is the set of local employee rights a worker residing in the Philippines is entitled to.

The best employers know that focusing on salary alone will only get you so far. You also need to create loyalty amongst your people. This is why employee benefits matter. They provide the support that impacts all aspects of people’s lives – our health, our happiness, our family, and even our future.