As an employer, what are you to do if an employee asks you to move back to their home country? Should you do the right thing and allow them to move back, and if you do, how do you deal with this from an operational perspective? Let's find out!

Marco Pasqualin leads Global Payroll at Boundless and has learned the ropes of payroll operations over the past 13 years working for the likes of Apple and Aldi. He has picked up unique insights on the complexity of global multi-country payroll, juggling dozens of inputs to produce correct payslips and compliance with local rules and laws. He shares the steps to set up international payroll in this post.

While the rise of mature tooling and services have enabled companies to more easily collaborate and create value with distributed teams than ever before, a legal and compliant remote work setup needs much more than great communication tools. We have already shared what are some of the employment challenges with remote workers and why hiring them as independent contractors is a bad idea in the long term. The only viable long-term solution is legally employing them and establishing international payroll processes. In this post, we offer an 8-step “Do-It-Yourself” guide to setting up international payroll operations for your company. You will need local expertise in terms of payroll processing, compliance, administration, and additional bank fees to transfer money in different currencies.

Before you can pay a single person a single cent, you have to be set up as an employer in the country where the worker is tax resident. In most countries that would entail opening a company and registering as an employer with the tax authorities. A notable exception are European Union countries. If your company is based in one of the 27 member countries, you won't necessarily need to open an entity in another member state but will have to register as an employer with tax and social security authorities. How long that would take and how complex it would be is different in each country, but as a rule of thumb, it will take longer than you think.

In some countries such as Ireland and the UK, you will deal with the same entity when it comes to income tax and social security (The Revenue Commissioners and HMRC, respectively). In contrast, in other jurisdictions such as Italy, Spain and Portugal, there will be two separate entities, increasing the complexity once it comes to filing taxes and notifying authorities each month.

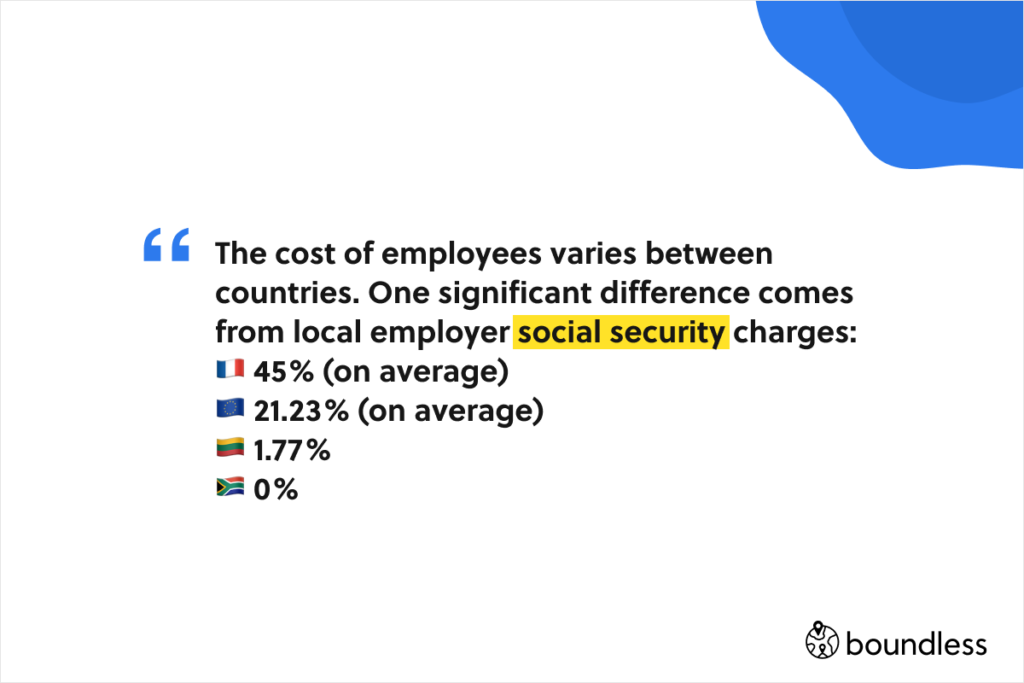

As we alluded to in our previous article, the cost of employees doing the same work but in different countries varies. One of the significant differences comes from the employer social security charges that companies are obliged to pay. Here are a few examples:

You will not be able to execute all the registrations and set up as an employer without the help of a lawyer and an accountant. You will also need to find a local payroll partner, or hire a payroll expert to help you with paying the appropriate salaries. Depending on the country, the use of a local payroll provider could cost you anywhere from €5-30 per employee per month.

Every country comes with local regulations which you need to adhere to from the moment you employ a tax resident of that country. Many of those regulations affect payroll directly: salaries have to be aligned with the minimum wage, employment contracts need to have all the necessary elements, working hours and paid time off have to be stipulated accordingly.

Beyond that, different countries will have various regulations when it comes to health and safety in case of accidents, as well as absence and sick leave. All these can affect the salary numbers every month, and you will need to know them very well.

Various personal information is vital in determining a salary. Personal employee information that you will need to collect initially includes employee name, address, family status, social security number or its local equivalent, date of birth, and bank account details. As this personal information is very sensitive, you have to make sure to keep it safe. Beyond that you will need to gather information on mandatory deductions such as payroll taxes, pay rate, pay frequency, regular earnings as well as overtime if that applies, salary, bonus and commission schemes, employee benefits such as retirement contributions, health insurance premiums, benefits-in-kind, etc. Best practices for keeping all the information safe include centralising personal data, storing it in a single and secure location, and avoiding duplicating information as much as possible (notably on paper).

Once you have collected personal information, it's vital to look out for changes and make regular updates; people move, change family status, have children, receive a salary increase, move from part-time to full time or vice versa, receive bonuses, add family members to their insurance packages, etc. Besides, employees may have been sick, taken unpaid time off work, etc. All of these things will have an impact on the month's salary.

While all of the above changes have to be monitored monthly, there are more significant ones to prepare for. Some are planned such as a new tax year. For example, the UK's new tax year is coming now in April, and it's bringing some notable changes to independent contractors. The transformations, as part of the IR35 regulations, may impact many contractors as their employment status will be assessed by the business they work with instead of on a self-assessment basis. This may mean that many contractors may have to pay Income tax and social insurance at the same rates as an employee, resulting in a decrease in their net pay.

However, there are more unexpected force majeure changes that also might happen and impact payroll. The world is currently undergoing a health crisis with the COVID-19 virus. At the time of writing this, Italian authorities have quarantined a host of towns in Northern Italy and ordered businesses to close down for a week. According to Italian employment law, the people that fall within the quarantine are entitled to CIGO - a special kind of unemployment benefit paid by Social Insurance when people are not allowed to work for very specific and temporary reasons, such as weather conditions or a quarantine. As we mentioned in our previous article on the fundamentals of international payroll, town municipalities in Italy tax their residents. That tax, which is different in every town, is deducted from the employee salary and filed by their employers. Employees who receive CIGO, however, are exempt from that tax. So in next month’s payroll, they would need to have the deduction removed from their salary.

Meanwhile in the UK, Prime minister, Boris Johnson has confirmed that individuals who self-isolate to protect others from the coronavirus will be entitled to Statutory Sick Pay (SSP), which normally is payable only after the fourth consecutive day of sickness. In this case, it will be available from day one of absence in cases relating to the virus.

Doing all the backend work around any of this is anything but trivial.

After you have initially set up your international payroll systems, each month there will inevitably be many changes you will need to input. You should have in place a system that tracks the changes and feeds it to the payroll provider. How the information from the source is transferred onto the payroll system is vital and needs to be considered very well. It's common for small companies to send the changes to payroll providers manually in an email. We would strongly advise against that as the chance of mistakes is too big, plus email comes with inherent privacy and security concerns when it comes to transmitting such information. Instead, work to create a process for storing the data in platforms and HR systems that automatically talk to payroll systems. Doing it manually is too unreliable.

Whatever HR system you choose, ideally you will want it to be automatically updating your payroll system because that means that whoever is responsible for payroll will have an easy way to check whether the output is correct. (Hint: this is built in the heart of the Boundless solution.)

Even if you have a robust process for tracking changes from your HR system to your payroll system or provider, the output for each employee in each country needs to be checked. It's an internal audit system, which we would recommend be performed by the person responsible for payroll. There are a couple of different ways to approach this:

Neither of these should produce vastly different numbers. If in either case there is a discrepancy, it can be investigated. Reasons for differences can be either that a mistake was made along the way, or there is some change like a bonus that hasn't been accounted for. Doing the audit will allow you to easily spot that and intervene before you have pressed the button to pay the person.

Even if everything is correct so far, there is one more step you have to do before you can pay your international employees: make sure money will hit their accounts on time. This is part of the international payroll treasury process, which is more complicated than it may appear. While technically you can pay a salary from your company's bank account, some countries will require you to have a local bank account to pay taxes and social insurance (Denmark for instance). Even if a country doesn’t have such requirements, we strongly recommend that you open a local bank account and use it for local payroll, as the alternative could create an accounting nightmare.

Whichever way you choose to proceed with, keep in mind exchange rate fluctuations that may change the final amount. We recommend using services such as TransferWise, which allow the sender to send a fixed fee, which removes the risk of uncertainty on the amount that the recipient will receive in their local currency.

International transfers take days, and foreign exchange can change a lot in that time. Whether you are transferring money to your accounts to pay from them or to your employees' accounts, you have to allow a couple of days for the money to arrive. One thing you have to be careful of that may delay you are bank holidays. You will need to know when they are in the country where you are paying payroll as on those days banks will not process money transfers. Similarly, be aware of cut off times at different timezones.

After all, this is done, you can push the button on salaries. However, after that is done, there is one more important step left.

After you have run payroll, you now have to deal with tax authorities, municipalities and all other entities where you are filing on behalf of your employees. You will need to send some information online to tax and social security authorities, informing them on how much you have deducted from the gross salary of the employee and how much of that sum is due to them. Once you have done that, different authorities will take the money in different ways, but most often it's a direct debit. You need to make sure that you will have the money in your bank account for them to take it out.

In the past, companies had to pay withholding tax and social contributions every month and consolidate them on a single annual return (i.e. P60 in Ireland). However, lately, many countries are applying a real-time reporting system. After having closed payroll and paid employees, a company would need to submit a filing (typically electronic) that contains several details of the payroll, which would vastly differ in various countries. More demanding in terms of the level of detail are the DSN in France, Uniemens in Italy, and Cret@ in Spain.

With that, a monthly cycle of payroll concludes. That is until next month when you have to do it all over again. One more thing that may be a challenge at any point is language barriers you may run into as you deal with local administration. It can be tough and intimidating but you shouldn't let that stop you from availing of diverse talent from all over the world.

At Boundless we steadfastly believe that you should be able to employ anyone anywhere compliantly and legally, and we’re working to make that possible. We can take care of international payroll amongst all other employment matters for your remote employees in Ireland, the UK, Denmark, Portugal, New Zealand, Singapore or Australia. Learn more here.

As an employer, what are you to do if an employee asks you to move back to their home country? Should you do the right thing and allow them to move back, and if you do, how do you deal with this from an operational perspective? Let's find out!

Payroll is the process and system by which a company pays its employees, and involves keeping employee financial records, calculating their paycheck taking wages, taxes, tax credits, allowances, and benefits-in-kind into consideration. Here is what you need to understand about international payroll.

There are many reasons why a company may consider outsourcing payroll operations. Before we get into how you will choose what the best payroll outsourcing option is for you, it's important to understand what your options are.

Every company has their story of how they became remote and distributed. At my last company, we became a distributed organisation organically, rather than proactively and here's how it worked.

The most crucial aspect of international employment is understanding the law in the country where your employee is relocating. Every place has its own unique rules on your contractual obligations, statutory notice periods, taxation, and employee protections.

A benefit in kind is any non-cash benefit of monetary value that an employer provides to employees. Unlike statutory benefits, which are mandated by the government, benefits in kind are something that a company offers at its own will.